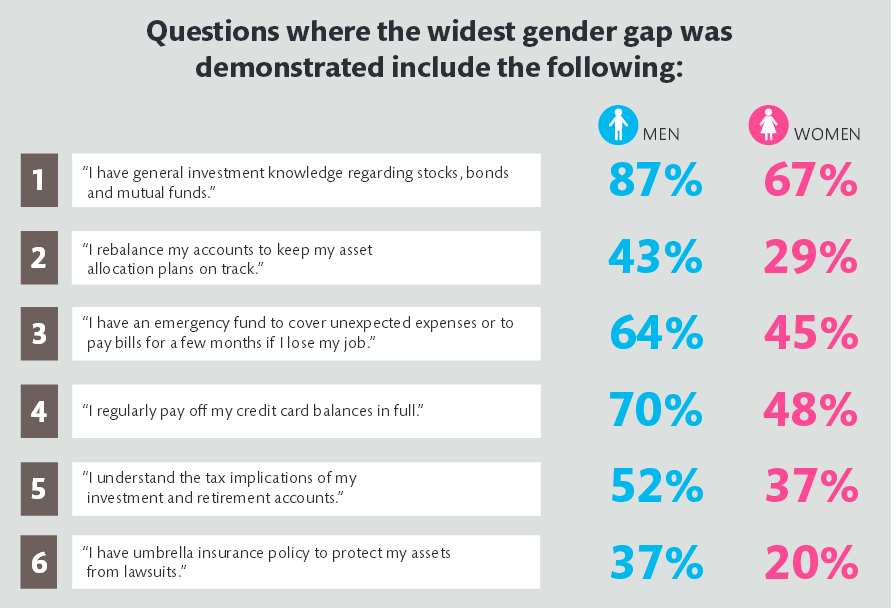

I absolutely love to read. Mystery, Romance, Suspense, it doesn’t matter the genre as long as I have a good book. But reading about finances and how to invest my funds? Snoozeville. It’s not that I don’t think these things are important, because they are. It’s the reading about how to invest, what I need to know about certain funds and general financial talk that puts me to sleep faster than sleeping pills. The sad truth, according to an article published by Financial Finesse, is 90% of women will be solely responsible for their finances at sometime in their lives due to the death of a spouse or divorce. This fact was borne home to me a few years ago when not one, but two, friends who were around Bryan’s age died suddenly of heart attacks. Over time I’ve began studying some simple financial truths to help take control of my future and decided to share them– in plain, easy to understand terms—without (hopefully!) causing a snooze fest.

1. Find out where your money is going. I know it doesn’t seem like it, but those little purchases add up. Whether it’s a daily grand latte or a supreme burrito, small purchases can take a big chunk out of your budget. By writing down all expenses for a month you’ll be able to see where your money goes. Follow this month by starting the dreaded “b” word–budget. Just be sure to plan for a few treats to keep from feeling deprived.

2. Organize all your paperwork. Do you know where your deeds, insurance papers and other important documents are in case you need them? Bryan was so freaked out after the death of his friends he immediately demanded I look through all the paperwork, wrote down where I could find passwords, and placed all our documents where I would know how to find them.

3. Make a savings and investment plan. I know this one is easier said than done. I have often wondered how there is so much week left after the end of the paycheck. We’ve found an easy way to save money is have some money removed directly from the paycheck each week into a savings account. If we don’t see it, it’s much easier not to spend it. We also keep a change jar. You’d be surprised how much change I can collect from pockets, couch cushions and the washing machine!

What are your favorite tips for women interested in learning more about their finances?

Thanks for the tips. I think we all should learn how to handle money nowadays.

This is great advice! The only problem for me is sticking to the budget. I’m all gung-ho for a couple of months, then get lazy and stop recording my spending. I need help on staying disciplined!

Fantastic advice thank you, my other half knows a lot more about saving accounts, ISAs, investing etc but I’m pretty good and juggling the everyday things.

Great advice for sure! My husband just took a mean fall and had to have a plate and screws in his face. He had to be taken to the big city Portland, by ambulance for surgery. I still can’t believe how he didi it and how easily it happened. I need to know so many things I don’t do for myself. Great things to think about for sure.

I’m good at the savings part but not at the investing part.

I am not very good with financial information. This is definitely great info. Thanks!

I too hate reading about finances and luckily my father taught me a lot before he passed away. I had to teach my mother how to take care of herself after he passed because he had done it for them and she had no idea what to do.

I don’t think for one minute it’s a gender gap other wise how do I as a women know how to handle the fiances. I was self thought. I think it’s a way that men suppressed women back in the days were men got away with doing abusive financial. Financial abuse is still abuse and most men back in the day wanted control and power that was the way to do it. But women got smart and put their big girl panties on and stood up against it. Now skip a few decades and you have older women teaching younger women how to do things the way it was suppose to be but you also have men who are teaching women to also be self reliant with out a man which is great even in a marriage it’s easier when there are two incomes now a days and the responsibility is split 50/50

I learned a lot of things from my dad and a class I took called geberal business,looking back what I learned help me survive a divorce along with raising two little ones.I educated my girls who value what I knew about finance and they thanked me. Its a very important thing to learn,finance

Finding out where your money is going is a HUGE way to increase your financial literacy. This post has got some great tips!

Great advice! My father died when I was a teen, leaving my mother the financial responsibilities of our household. I watched her have to learn so much and as a result made sure I learned early on how save, spend and invest wisely. This was a great and much needed post!